CHOCOA 2024

SPOTLIGHT ON SUSTAINABILITY, QUALITY

AND CRAFTMANSHIP

The Amsterdam Cocoa Week, co-hosted by the World Cocoa Foundation and Chocoa, was a bustling hub of educational sessions, keynotes, tastings, panel debates and networking opportunities. Participants from every corner of the global cacao industry -growers, producers, suppliers, and consumers- convened for insightful discussions and valuable connections.

Our SILVA team came back with inspiration and reflections, which we are happy to share. Here you will find our impressions and insights – contextualised within the broader cacao value chain, along with our call to keep raising the bar…

CHOCOA 2024 | OVERALL VIBE

This year’s Chocoa, the renowned annual marketplace for cacao and chocolate, celebrated its 12th edition in Amsterdam, spotlighting quality and sustainability.

In a first-ever collaboration, it transformed into the “Amsterdam Cocoa Week” through a partnership with the World Cocoa Foundation. This week-long event featured the World Cocoa Foundation’s Partnership Meeting on February 5th and 6th, followed by the Chocoa Trade Fair from February 7th to 9th, and the Chocoa Chocolate Days on February 10th and 11th.

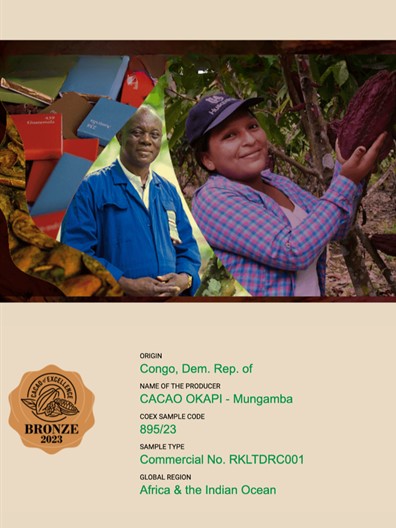

In addition to these events, Chocoa also hosted the Cacao of Excellence, a celebration of the quality and diversity of cocoa worldwide. The award ceremonies recognised the top 50 cocoa samples from around the globe, drawing international attention and further enriching the event’s global presence.

The audience was notably diverse, with attendees ranging from those in formal “suit-and-tie” attire to a more casual dress code, reflecting the event’s broad appeal and engagement within the cacao and chocolate industry.

The Chocoa Trade Fair featured booths representing numerous countries, cacao-producing organisations, international bean-to-bar brands, cacao sourcers, importers, bean-to-bar machine makers, non-profit organisations, and technology applications aimed at digitising value chains.

Networking was a central focus throughout the event, fostering connections through informal gatherings, formal conferences and meetings, and shared experiences during tastings of chocolate, beer, wine, and other fine food and drinks.

SILVA CACAO’s KEY HIGHLIGHTS -amidst the joy of reconnecting with old friends and colleagues, include: Rising cacao prices, European Union Deforestation Legislation, Chocolate Innovations & Success Stories, The international Bean Scene, United Forces for a better chocolate world and the Call to Continue Raising the Bar for Chocolate Sustainability…

SPOTTED | TWO ELEPHANTS IN ‘DE BEURS VAN BERLAGE’

Out of the spotlight, but still unmistakably there, we spotted two elephants in the room. Two large, unavoidable issues that everyone was aware of but were hesitant to confront; the soaring cacao prices and the European Union Deforestation Regulation (EUDR).

ELEPHANT IN THE ROOM #1 : RISING CACAO PRICES

The issue of rising cacao future prices was widely known at Chocoa 2024, sparking discussions and concerns among participants. In fact, a record high of $6 per kilogram was reached on the 4th day of Amsterdam cacao week…

Source: Trading Economics

Throughout both formal conference sessions and informal discussions, there has been a thorough examination of the underlying factors driving the current cacao market dynamics.

In cacao-producing regions, significant deficits result from various factors:

- The challenging weather conditions, including droughts, heavy rainfall, and storms, often attributed to phenomena like El Niño, have had a profound impact on cacao production. This has resulted in a significant decrease in production not only in key cacao-producing nations like Ivory Coast and Ghana but also in other regions where cacao is cultivated. These conditions not only hindered the growth of cacao trees but also made it challenging to transport cacao from farms to processing centers and warehouses.

- Premature and late flowering caused by these weather conditions, along with the spread of diseases, made harvesting more complicated and affected the quality of the beans.

- Issues with bean quality arise during the dry season because of unexpected levels of humidity.

- Cacao farms were less productive due to several reasons: COVID-19 caused prices of fertilisers and pesticides to rise, along with increasing energy costs and historically low cacao prices in previous years. These factors led to insufficient investment in the farms, resulting in lower production.

- After harvesting, the post-harvest process became more difficult due to irregular and unpredictable cacao flows. Additionally, rainfall during the drying process in certain regions led to a loss of exportable cacao volumes, further complicating matters for producers.

The unpredictability of harvest times and resulting delays complicates the market further. With prices rising, many cacao stakeholders hesitate to finalise purchases, leading to uncertainty and pressure on immediate availability while diminishing physical stocks.

If the market were solely driven by physical supply and demand and hedging against volatility, the situation would be clearer. However, cacao is also traded on the New York Mercantile Exchange (NYMES) and the Intercontinental Exchange (ICE) in London. Speculation and paper trading on these markets by actors both inside and outside the cacao sector further contribute to price fluctuations and volatility.

Moreover, the ongoing Red Sea crisis worsens cacao availability as sailings from Southeast Asia and East Africa rerouted through the ‘Cape of Good Hope’ in South Africa face longer transit times and increased costs.

While prices for specialty cacao stayed fairly steady in the initial months of 2023, subsequent rises in late 2023 and 2024 call for adaptations. Eventually, fixed or ‘outright’ prices for specialty cacao will need to rise accordingly to maintain the quality premium for cacao producers who dedicate resources to careful harvest and post-harvest processes. Although quality premiums continue to be offered, the difference compared to conventional markets is shrinking, which adds risks to the supply of specialty cacao if fair prices are not maintained.

➙ This mix of deficits in several cacao-producing regions and significant market fluctuations towards higher prices highlights the critical need for access to finance and capital. It becomes a struggle for cash, where being the first to pay often takes precedence, potentially impacting the availability of specific qualities and quantities.

We hear many cooperatives and farmer groups expressing concerns. Loyalty to cooperatives faces challenges due to direct cash payments that may tempt farmers, even with existing contracts in place. Beyond just providing financial resources and credit, there is a pressing need for additional support to help cacao-producing regions finance and pre-finance their operations, ensuring a secure and reliable supply chain.

ELEPHANT IN THE ROOM #2 : EUROPEAN UNION DEFORESTATION LEGISLATION

The European Union Deforestation Legislation was another significant topic, approached cautiously due to its complexity.

In a nutshell, this legislation (EUDR) requires us to:

- Map the entire supply chain.

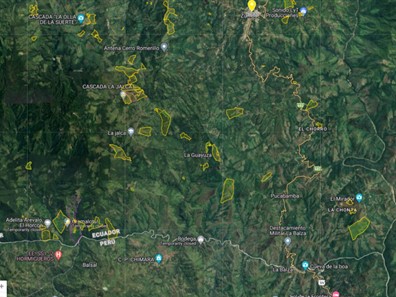

- Geolocate all farms in the chain, using polygons for farms larger than 4 hectares and GPS points for those smaller than 4 hectares, and document the legality of the farm

- Conduct a risk assessment on deforestation up to December 30, 2020.

- Establish a batch chain of custody.

- Provide a due diligence statement.

KEY POINTS TO CONSIDER REGARDING THIS EUDR LEGISLATION

➙ Challenges for cacao producers, sourcers, and importers -particularly smaller entities, in meeting compliance requirements:

• The process of interfacing and benchmarking is costly.

• There is a short timeframe for implementation.

• Initiatives lack cohesion, with no unified sector approach; each entity navigates independently from a private standpoint.

• Open-source data and historical reference maps have low resolution, making it difficult to determine if areas are in risk zones.

• The risk of data corruption and leakage is a significant concern, as it can lead to various negative consequences

➙ The absence of a unified sector approach was highlighted. Ideally, there should be support from countries for a national approach in each cacao-producing area to ensure consistent data collection, available to all cacao producers, rather than disjointed initiatives that only guarantee compliance for a fortunate few. Some countries, like Vietnam and Costa Rica, have made significant strides in establishing national systems. However, for others, understanding the requirements, coordinating efforts, and organising national support programs prove to be challenging and need more time.

➙ While the concept of the legislation -aimed at preventing deforestation and harnessing commodities like cacao, coffee, rubber, wood, and cattle for positive impact, is widely endorsed by many stakeholders in the value chain, there is a CLEAR REQUEST AND URGENT CALL FOR:

- Step-by-step implementation without immediate punitive measures, accompanied by a longer inception period to ensure and allow everyone to be on board.

• Clear guidelines for addressing ambiguous aspects of implementation.

• Enhanced support systems at both national and subnational levels

➙ INTERESTING EUDR LINKS TO CONSULT

EUDR – FAQ

Benchmark reference map: EU Forest Observatory

CHOCOA 2024 | INTERNATIONAL BEAN SCENE

Chocoa 2024 boasted a diverse international attendance, with participants from all continents and numerous countries and regions.

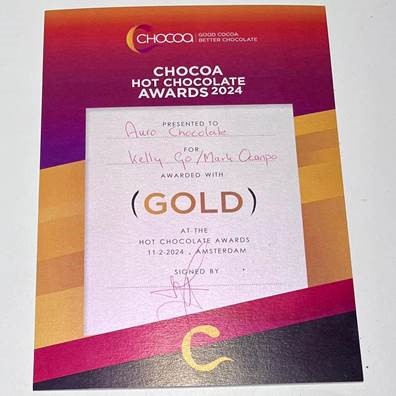

• Asia was notably well-represented, with attendees from countries like India, Indonesia, Thailand, the Philippines, Pacific Islands, and Vietnam, highlighting the continent’s growing importance in the world of cacao, along with showcasing many prized products. Special Shout Out to our partners Mark Ocampo and Kelly Go – Founders of AURO Chocolate, panelists of keynote ‘The future of chocolate, is it liquid?’ and gold medal winners of ‘Chocoa Hot Chocolate Awards 2024’.

• The event featured a rich variety of high-quality African cacao, challenging longstanding biases against African cacao. With 54 countries, 1.4 billion people, and a diverse range of cacao genetics, producers and production systems, it’s time to appreciate the continent’s vast potential. Awards given to cacao beans from Togo, Congo, Cameroon, and Cote d’Ivoire serve as testament to this diversity. Angola, a new player in the world of cacao origins, is making a notable debut on the fine flavour map. With enthusiasm, they are keen to share their unique cacao offerings with the market.

• Central and South America, along with the Caribbean, maintained their strong presence at the event, showcasing outstanding cacao qualities and the participation of numerous cacao producers. Stay tuned for some exciting new Central American cacao flavours very soon!

UNITED FORCES FOR A BETTER CHOCOLATE WORLD

The community of bean-to-bar makers is expanding, with established associations in France, Spain, Italy, Japan, Portugal, Brazil, and informal networks of individuals who share the same values.

At Chocoa, groundwork was laid for the establishment of an international Bean-to-Bar Federation: a broad coalition of national and regional associations, networks, and stakeholders aiming to promote transparency, traceability, and sustainability in the cacao/chocolate supply chains.

Transparency, inclusivity, advocacy, education, information, and collaborative growth are the core values and driving forces uniting this community. Interested in joining or learning more? Check out their Facebook Page.

CHOCOA 2024 | INNOVATIONS & SUCCESS STORIES

• Chocoa 2024 showcased new innovations, including novel products and techniques focused on enhancing quality and embracing circular economy principles such as recycling and reusing by-products.

• The range of cacao drinks and pulp derivatives is expanding, offering a means to utilise by-products while generating additional income for cacao producers and driving product innovation.

• Creative uses of cacao pods, such as cacao jewelry, paper, and artistic creations, were on display.

• Chocolate innovation has been highlighted by imaginative inclusions and infusions, showcasing an elevated level of technical expertise among chocolate makers. This trend fosters increased creativity and experimentation, which includes the incorporation of alcohol-infused inclusions. Additionally, the use of locally sourced herbs, spices, and other ingredients adds further distinction and identity to the products.

• New approaches to consuming cacao-based products were highlighted. Shout Out to Ander Roaster, Brewer, Cacao Explorers‘ innovative cacao drink offerings and congratulations to AURO Chocolate, for winning the ‘Chocoa Hot Chocolate Awards 2024’.

• A dedicated session provided a platform for candid discussions on both achievements and setbacks within the craft chocolate sector, with perspectives shared by Raaka, Hasnaa Chocolat, Nearynogs, and Wild Child Cacao.

• New concepts, methods, and flavour blends were examined to enhance the experience of pairing, sharing, and tasting, drawing inspiration from various craft industries. There was a strong emphasis on consumer education to take chocolate experiences to a higher level.

FUTURE OUTLOOK | LET’S PERSIST IN RAISING THE BAR

Over the past decade, there has been a notable learning curve and overall improvement in the quality of cacao and the level of knowledge within the sector. Terms such as ‘single variety cacao’ and the skillful execution of ‘precisely controlled post-harvesting protocols’ and ‘expert roasting techniques’ exemplify this advancement.

However, this quality evolution is happening rapidly, and knowledge is not yet uniformly distributed among all stakeholders in the supply chain.

At the core of the word “SUSTAIN-ability” lies the concept of preserving what we currently have for the benefit of future generations.

In these tumultuous times characterised by price fluctuations, quality uncertainties, climate change, and evolving legislation, we strongly advocate for the decommoditisation of our cacao supply chains. By prioritising sustainable partnerships and relationships, we can create stability for cacao producers at the very beginning of the value chain.

Continuing to raise the bar in terms of quality, transparency, and sustainability is essential for the long-term viability of the cacao sector. An ongoing commitment to improvement will help safeguard the future of cacao production for generations to come. Let’s persist in raising the bar !

KUDO’S, CREDITS & INSPIRATION

EUROPEAN COMMISSION : Frequently Asked Questions – Deforestation Regulation

SILVA : RAISING THE BAR WITH SINGLE VARIETY CACAO

JOIN OUR ONLINE COMMUNITY

Silva Newsletter via contact form

Instagram | Silva_Cacao

Facebook | Silva-Cacao

LinkedIn | Silva Cacao

LinkedIn Newsletter | The Friday Bean Press