KEY INSIGHTS, TAKEAWAYS AND BEST PRACTICES FOR EUDR COMPLIANCE

A Focus on Forest Preservation and EUDR Compliance

The European Union Deforestation Regulation (EUDR) accelerates our vision, and we’re using this opportunity to reaffirm our commitment to maintaining deforestation-free supply chains ensuring EUDR compliance.

EUDR compliance remains a controversial and complex topic -as highlighted by recent developments.

On Tuesday 17 December 2024, Parliament adopted the provisional political agreement with the Council to delay the application of the EU Deforestation Regulation.

Large operators and traders will now have to respect the obligations of this regulation as of 30 December 2025, and micro- and small enterprises from 30 June 2026. This additional time is intended to help companies around the world implement the rules more smoothly from the date of application, without undermining the objectives of the law.

Before the one-year delay can enter into force, the agreed text also has to be endorsed by the Council and published in the EU Official Journal before the end of 2024 -a process unlikely to encounter further issues.

SILVA : READY FOR EUDR COMPLIANCE

Anytime and Beyond

At SILVA Cacao, we have been closely monitoring the developments surrounding the EUDR to ensure we are fully prepared for its implementation, no matter the timeline. Our commitment to full compliance with the EUDR remains steadfast. The extra time granted will allow us to delve deeper into the requirements, enabling us to provide even greater value.

Our Chief Cocoapreneur, Katrien Delaet, shared her insights and experiences regarding SILVA Cacao’s progress towards EUDR compliance. Her expertise in fieldwork and sustainability offers valuable guidance to European chocolate makers and stakeholders as they navigate the industry’s challenges and opportunities.

This in-house knowledge equips SILVA Cacao to provide customised support to our partners -producers, exporters and chocolate makers, in achieving sustainable, deforestation-free cacao. Our approach aligns with our core values by promoting collaboration among partners, reducing duplication of efforts and openly sharing practical tips and insights. At SILVA Cacao, we emphasise tailored strategies and personalised advice, highlighting our strong commitment to forest conservation and restoration.

THE EUDR IS SHAKING UP THE CACAO INDUSTRY

Demanding a Dramatic Shift towards Full Traceability

The 2022 Cocoa Barometer highlighted that only 37% of traced and processed cacao could be tracked to the farm level, while 57% could be tracked to the cooperative level.

The EU Deforestation Regulation (EUDR) -one of the most stringent and comprehensive environmental laws in the EU, aims to ensure that 7 key consumer goods (soy, cattle, oil palm, wood, coffee, cacao and natural rubber) and some of their derivatives placed on the EU market are free from deforestation.

For our beloved cacao sector, this translates as follows:

Fundamentally, the EUDR dictates that all cacao and derivates entering or leaving the EU must comply with these principles:

- Deforestation-Free: Ensuring that cacao products purchased, used, and consumed by Europeans do not contribute to deforestation or forest degradation, both within the EU and globally.

- Compliance with Local Legislation: Cacao must adhere to relevant legislation in its country of production -including laws on environment, land use, forest governance, labour, tax, and human rights.

- Due Diligence: Each shipment must be accompanied by a due diligence statement, confirming minimal risk of non-compliance with EUDR requirements.

The workload for mapping forest and cacao growing areas under the EUDR is a joint effort of both producers and importers. Cacao producers with less than 4 hectares of cacao are required to provide a GPS pin marking the center of their plot, while producers with more than 4 hectares must also use ‘polygon mapping’, a more detailed method that outlines the boundaries of each plot.

This strict, zero-tolerance approach -where products are either compliant or not, places significant pressure on producers and importers (in our sector: importers of cacao beans, butter, mass, but also importers of chocolate products and other derivates) to ensure accurate and comprehensive data collection.

KEY INSIGHTS, PRACTICAL TAKEAWAYS AND BEST PRACTICES ON EUDR COMPLIANCE FOR OUR PARTNERS

I. IMPACT OF EUDR ON CACAO PRODUCERS

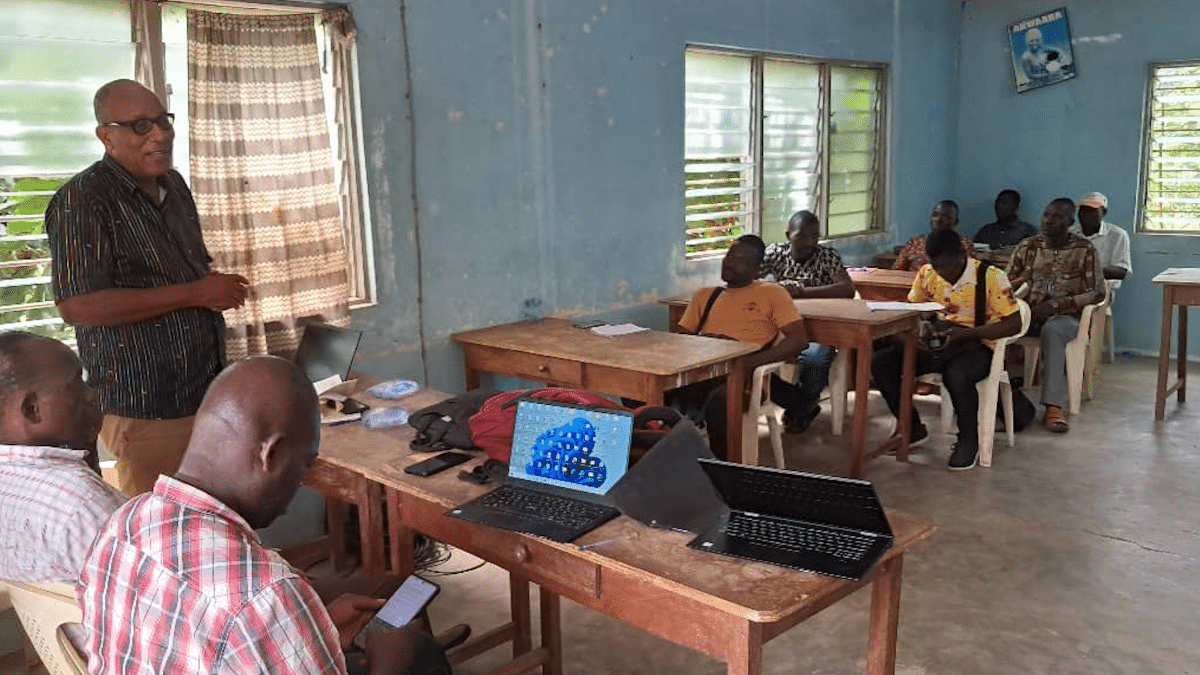

A. SILVA CACAO X PRODUCER PARTNERS

EUDR COMPLIANCE VS FIELD REALITY

‘Farmers in developing countries are now suddenly expected to have smartphones and become tech-savvy enough to map their cacao growing areas and interpret satellite imagery’, explains Katrien. ‘While the technological demands -such as handling geo-location data, are already challenging, the legal obstacles are even harder to overcome. In many of these regions, land ownership is often uncertain. As a result, the EUDR legislation can feel disconnected from the practical realities these farmers face on the ground.’

Katrien continues: ‘So maybe let’s start by addressing the in-the-field realities, such as the challenges related to boundaries and the associated costs of data collection for smallholder farmers. Farmers must be involved in identifying plot boundaries, as they know the land best. But mapping every farm -especially for smallholders, involves significant resources, including time, people, and financial expenses. Even getting to remote farms is challenging due to poor infrastructure, and many farmers don’t live near their plots. The EUDR mandates geolocation for every cacao plot to demonstrate that no deforestation occurred after 30/12/2020. This involves advanced geolocation techniques and ground-truthing, often requiring enumerators and farmers to work together. There’s a significant gap between the expectations set by EUDR regulators and the realities faced by farmers and data collectors on the ground. In many African countries, farmers frequently rely on informal methods, such as memory or handwritten notebooks, to manage their business data.’

Katrien concludes: ‘Collecting accurate, formalised data for regulatory purposes is quite a challenge. The process is more effective when personal relationships are built, because qualitative insights are more easily gathered when data collectors build a relationship with farmers. At SILVA Cacao, we have always taken pride in naturally building purposeful partnerships, a practice we genuinely enjoy. This approach is beneficial at all times, but it is especially essential right now.’

B. SILVA CACAO’S TAKEAWAYS

→ Any EUDR compliance effort must consider the socio-economic realities faced by smallholder farmers, who risk losing market access if they cannot meet the requirements. Developing an inclusive approach should be a priority when building sustainable supply chains.

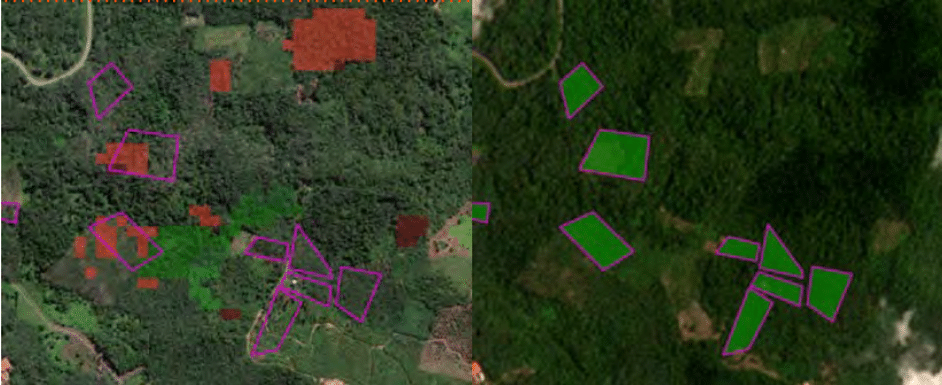

→ While technology -such as satellite data, is crucial for compliance, manual interventions and human judgment are often needed to correct inaccuracies and ensure reliable results; ground truthing is a must!

→ These challenges and insights emphasise the need for realistic and context-sensitive approaches to EUDR compliance, balancing regulatory demands with the practical needs and limitations of farmers and supply chain participants, specific to each country of origin.

→ Although the EUDR has commendable intentions, questions remain about its effect on cacao producers. There are concerns that it could unintentionally benefit larger producers and hinder inclusiveness and diversity in the industry.

→ The EUDR regulation is still evolving, with several grey areas remaining in the legislation. Additionally, many countries of origin face ongoing political and economic instability, presenting significant challenges. A one-size-fits-all approach simply doesn’t exist.

C. SILVA APPROACH

→ At SILVA Cacao, traceability was already ensured, and we view this regulation as an opportunity to further improve transparency in our supply chains.

→ We recognise the pressures this regulation can place on farmers, so our approach is flexible, collaborative and progressive.

→ We created a clear guideline document for our partners, outlining the technical details of data requirements such as geolocation, traceability, legality, and harvest periods. Our approach is customized with tiered engagement levels, from basic data submission to full risk assessments. We engage in dialogue with all our partners, adapting to each supplier’s specific needs.

→ We continue to provide sustainable agroforestry practices where cacao grows in harmony with nature.

→ Our purpose is to navigate the new regulation collaboratively, teaming up to ensure compliance while offering tailored support, avoiding redundant efforts and unnecessary verification costs.

II. WHAT DOES IT MEAN FOR CHOCOLATE MAKERS, FROM SMALL TO LARGE ?

Katrien: ‘Now that you understand the work required both in the field and during the import of cacao for the European market, let’s summarise the implications for European chocolate makers: Companies lacking strong policies on sustainable sourcing and deforestation will face significant challenges. For Silva Cacao, with “F for Forest” ingrained in our core values, this means simply stepping up our efforts. The EUDR aligns with our sourcing strategy and standards, which we’ve been investing in for years, even before these regulations were introduced.’

A. SILVA CACAO TEAM UP WITH CHOCOLATEMAKERS VS EUROPEAN BEAN TO BAR REALITY

‘As an importer’, Katrien explains ‘SILVA Cacao must ensure that all cacao beans are traceable to the specific plot of land where they are grown. This involves providing geolocation and legality data for the production areas. We also need to assess and mitigate the risk of our cacao contributing to deforestation by thoroughly examining supply chains. To validate that no deforestation occurs in our sourcing areas, we use a combined approach of satellite imagery and artificial intelligence. SILVA Cacao teams up with a private service provider for satellite images, integrating open-source data such as Global Forest Watch Pro and Whisp.’

Katrien: ‘Once documentation confirms there is no or minimal risk of non-compliance, SILVA Cacao must submit a Due Diligence Statement (DDS) via the EU Information System (TRACES). This submission generates a DDS reference number, which is required for the product to be released for circulation within or export from the EU market.’

‘Once the cacao has cleared customs and is within European territory, the requirements change’, Katrien explains. ‘Large downstream operators (such as couverture makers, major chocolatiers, or butter processors) must meet similar due diligence obligations and submit a DDS based on a previous reference number. In contrast, SMEs are not required to submit a due diligence declaration if it is already covered by another economic operator. They only need to provide the reference number of the existing declaration if requested.’

Katrien: ‘Once the EUDR enters into application, SILVA Cacao will consistently include our DDS numbers on every invoice to directly demonstrate the compliance of the beans we sell, ensuring automatic and direct information transfer to our small and medium-sized chocolatiers in Europe. Additionally, larger customers will receive a security token for access to the EU platform and automated transfer of geo-data.’

Katrien resumes: ‘The Regulation was published in the Official Journal of the European Union on June 9, 2023, and took effect on June 29, 2023. For now, the actual enforcement is set to begin on 30 December 2025 for most companies and on 30 June 2026, for micro- and small enterprises. It’s important to note that the European Commission’s proposed 1-year phase-in period is still pending approval by the European Parliament and the Council, which could potentially delay these dates by an additional year. Rest assured, we will stay on top of things and be ready whenever needed.’

B. SILVA CACAO’S TAKEAWAYS

→ The EUDR differs from other legislation because it is product-based and centers on prohibitions, unlike the CSDDD or the German Supply Chain Act (LkSG), which focus primarily on due diligence and best efforts.

→ If chocolate makers process cacao beans after the enforcement date of December 30, 2025, they must provide evidence that the cacao was imported into the EU before this date (as per order request, transport document, or invoice). Or in case the chocolate is made with cacao introduced to the market after December 30, 2025, they must demonstrate that the beans are deforestation-free by providing the respective DDS number.

→ While certified cacao ensures traceability up to the farm level, it does not necessarily guarantee EUDR compliance. Certification is a significant step in the right direction, but it is not sufficient for geo-data requirements. Many certification organisations, such as Rainforest Alliance and Fairtrade, have developed support systems to help demonstrate compliance.

→ What does this mean for specialty cacao? While traceability is a crucial aspect and assurance for all specialty cacao, the resources required to comply with the EUDR are substantial relative to the volumes sourced. This includes the burden of data collection, risk assessment, and validation. As a result, the specialty sector faces a significant challenge.

→ The workload* required to achieve EUDR compliance is substantial, and its impact on the cacao industry is immense, affecting nearly all supply chain actors. Non-compliance could result in fines of up to 4% of annual turnover, potential confiscation of shipments, and the loss of access to a market that represents half of global cacao consumption.

C. SILVA CACAO’S APPROACH

→ SILVA Cacao makes compliance easy and hassle-free by streamlining the process. Starting in late December 2025, every SILVA Cacao invoice will include the DDS reference number from the EU IT platform for cacao imported and cleared after December 30th, 2025. This ensures geolocation and legality compliance (batches cleared before this date are exempt). In addition, our larger customers will receive a security token to access the EU platform.

→ If required, we are available to provide detailed information to demonstrate compliance during controls or audits by your competent authorities.

REFLECTING ON EUDR COMPLIANCE

Looking Back, Up Close, From Afar and Beyond

Meeting EUDR compliance poses several challenges for cacao producers, sourcers and importers -especially smaller players.

The short timeframe for implementation is one of the biggest hurdles, requiring rapid adaptation across the industry. Additionally, the lack of a unified sector approach means that many initiatives are fragmented, with private companies working in isolation rather than collaboratively. This disjointed effort leaves many struggling to meet the requirements on their own.

Another significant challenge lies in data accuracy. Open-source data and historical reference maps often have low resolution, making it difficult to accurately identify risk zones. While high-resolution satellite maps provide a much clearer picture, they are expensive, creating an additional cost burden for those aiming to ensure compliance. While the EU observatory is producing reference maps to ensure compliance, these are not yet up to standard. The additional 12-month implementation period can be well spent finalizing and refining benchmark reference maps to ensure correct and effective implementation.

National-level support systems are also inconsistent and may vary widely. Countries like Costa Rica and Ecuador have advanced systems to help cacao producers collect the necessary data and consolidate compliance at the national level, rather than relying on private efforts. Meanwhile, other countries lag behind, making it more difficult for producers to coordinate and manage compliance. A more unified, national-level approach to data collection and compliance would ensure that all cacao producers -not just a select few, are equipped to meet these new regulations. The additional 12-month implementation period will have a positive impact on the development of national suppliers and the inclusiveness of producers.

The timing of EUDR implementation couldn’t be more challenging. After a year marked by deficits and disruptions within the cacao value chain, these new regulations add even more pressure. However, while the workload is intense, the demand for traceability is here to stay, and this can offer long-term benefits to the industry.

For chocolate makers, traceability will soon become a must. Where consumers once chose their favourite chocolate bar based on ‘colour’ -dark, milk, or white options, they will now expect transparency about the origins of the cacao. This presents a valuable opportunity for chocolate makers to connect more deeply with the origins and producers behind each bean, creating a stronger identity for their products.

However, it’s essential to remember that traceability alone is not enough. True transparency requires understanding not just where the cacao comes from, but also how and by whom it was produced. For the specialty cacao sector, this deeper level of transparency is a unique selling point, setting it apart in a crowded market.

In addition to traceability and transparency, the focus on deforestation highlights the importance of recognising cacao forests as entire ecosystems. These ecosystems provide more than just land for cacao farming; they offer valuable services like carbon storage, water availability, and biodiversity. It’s essential to find ways to value the entire system, not just the forest itself.

As the industry faces these challenges, there’s an opportunity to step back and look at the bigger picture. By coming together, we can turn these obstacles into opportunities for deeper collaboration, enhanced transparency, and a stronger commitment to sustainability. Let’s work together to meet EUDR compliance and go beyond it, creating a future where the cacao industry thrives while protecting both the environment and the people behind it. Nature positive is the way forward!

At SILVA Cacao, our core fundamentals -Forest, Farmer, Flavour, Future, and Fun, guide us as we navigate the complexities of EUDR compliance. By prioritising sustainable ecosystems, supporting cacao farmers, celebrating unique flavours, and driving industry-wide collaboration, we are committed to a future where traceability and transparency are the norm, and the cacao industry thrives in harmony with the environment.

KUDO’s, CREDITS & INSPO

*The workload for EUDR compliance is immense, but to keep it brief -in a nutshell:

- Mapping the entire supply chain.

- Geolocating all farms (polygons for farms >4 hectares, GPS for <4 hectares) and document legality.

- Conducting a risk assessment on deforestation up to December 30, 2020.

- Establishing a batch chain of custody.

- Providing a due diligence statement.

- The latter must accompany every container imported into the EU as of December 30, 2024 (or 30 December 2025 – if the phasing-in periode of 1 year gets approved by Parliament and Council)

definition SME – according to Article 3 of Directive 2013/34/EU of the European Parliament and of the Council:

Enterprises which on a consolidated basis, do not exceed the limits of at least two of the three following criteria on the balance sheet date of the parent undertaking: (1) Balance sheet total: EUR 20 000 000; (2) Net turnover: EUR 40 000 000; (3) Average number of employees during the FY: 250.

definition ‘ground-truth’

EUROPEAN UNION – Press Release dd 17 December 2024

EUROPEAN UNION – Guidance on EU Deforestation Regulation

EUROPEAN UNION – Proposal for a Regulation amending Deforestation Regulation as regards the date of application

EUROPEAN UNION – Frequently Asked Questions – Deforestation Regulation

EUROPEAN UNION – EU Deforestation Union – An Opportunity for Smallholder

EUROPEAN UNION – SME Factsheet